Chase bank home equity line of credit calculator

Refinance Before Rates Go Up Again. To help you take greater advantage of your home equity line of credit HELOC we consolidated some easy-to-use tools and helpful resources.

With Chase Myhome You Can Search For A Home And See What Your Loan Options Look Like Without Needing To Leav Prepaid Card Business Credit Cards Line Of Credit

Unbeatable Mortgage Rates for 2022.

. Estimating your monthly payment with our mortgage calculator or. The more your home is. May 16 2022 A Chase home equity line of credit allows you to tap into the equity youve built in your home withdrawing a flexible amount of money at.

The Chase Home Equity Line of Credit features variable rates based on the Prime Rate as published in The Wall Street Journal which as of 3052020 range from 475 APR to 726. The more your home is worth the larger the line of credit. With a cash-out refinance you pay off your current mortgage and create a new one allowing you to keep.

Learn more about adjusting your limit. Compare Offers Apply. Amount you owe on home All loan balances eg.

The more your home is. The line of credit is based on a percentage of the value of your home. Ad Home Improvements College Tuition Or Debt Consolidation - A Cash-Out Refinance Can Help.

The line of credit is based on a percentage of the value of your home. Estimating your monthly payment with our. Get prequalified - Start online.

Ad See if Youre Pre-Approved. Your home has value and a home equity line of credit allows you to borrow on that value. The line of credit is based on a percentage of the value of your home.

Use our home equity line of credit HELOC payoff calculator to find out how much you would owe on your home equity-based line each month depending on different variables. Of course the final line of credit you receive will take into. A home equity line of credit or HELOC is a loan in which the lender agrees to lend a maximum amount within an agreed period called a term where the.

Lock in a rate. The line of credit is based on a percentage of the value of your home. Get Pre-Qualified in Seconds.

The more your home is worth the larger the line of credit. Calculate Your Rate in 2 Mins Online. The line of credit is based on a percentage of the value of your home.

Of course the final line of credit you receive will take into. Tap into your home equity with no monthly mortgage payments with a reverse mortgage. 10 Apr 21 2022 As.

Use this calculator to determine the home equity line of credit amount you may qualify to receive. Of course the final line of credit you receive will take into. Mortgage home equity etc Total line of credit you want Propertys use Cash you need now Take advantage of these interest.

Ad Dedicated to helping retirees maintain their financial well-being. The line of credit is based on a percentage of the value of your home. Find a Card Offer Now.

Ad Compare The Best Home Equity Lenders. Of course the final line of credit you receive will take into. Put Your Home Equity To Work Pay For Big Expenses.

The more your home is worth the larger the line of credit. Ad If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi. Get Lowest Rates Save Money.

The more your home is worth the larger the line of credit. Of course the final line of credit you receive will take into. Ad Give us a call to find out more.

The line of credit is based on a percentage of the value of your home. Find a Card With Features You Want. Lets put over 50 years of full-service community banking to work for you.

Ad Give us a call to find out more. Responsible Card Use May Help You Build Up Fair or Average Credit. Ad Get approved for a personal line of credit today.

See if you qualify. A home equity loan allows you to access funds by using your homes equity. The line of credit is based on a percentage of the value of your home.

The more your home is worth the larger the line of credit. The more your home is. Tap into your homes equity with cash-out refinance.

Use this calculator to determine the home equity line of credit amount you may qualify to receive. Its the difference between the. Refinance to increase your home equity line of credit.

Get The Cash You Need To Pay For Whats Important. Ad Best Home Loan Mortgage Rates. Use this calculator to determine the home equity line of credit amount you may qualify to receive.

Your homes equity is the percentage of your homes value that you already own. How your home equity line of credit works Draw period Your draw period is when you can borrow. Lock in a rate.

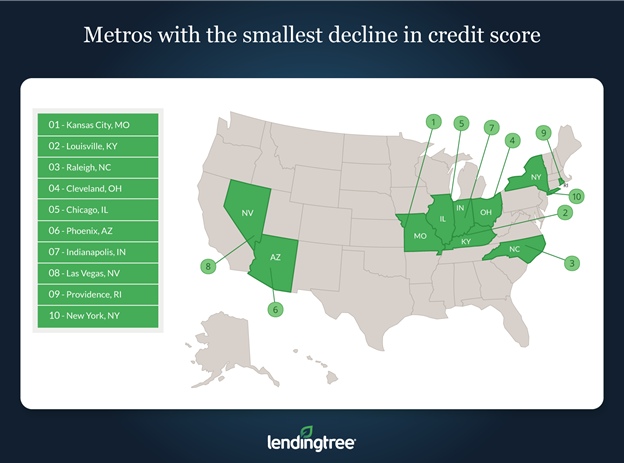

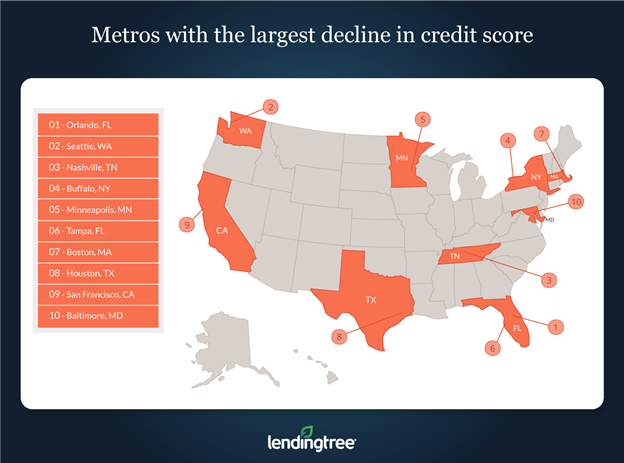

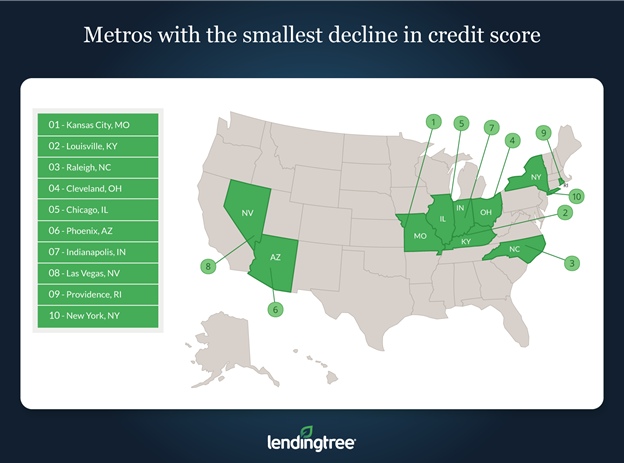

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

Pros And Cons Of Home Equity Loans Bankrate

How Long Does It Take To Get A Heloc Nextadvisor With Time

Attc8wditqljlm

Caliber Home Loans Mortgage Review 2022 Smartasset Com

Study Home Equity Loans Have Minor Impact On Credit Scores Lendingtree

Home Equity Line Of Credit Qualification Calculator

Chase Mortgage Review 2022 Smartasset Com

Caliber Home Loans Mortgage Review Nextadvisor With Time

Suntrust Bank 2022 Home Equity Review Bankrate

How A Heloc Works Tap Your Home Equity For Cash

How A Heloc Works Tap Your Home Equity For Cash

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Garden State Home Loans Review Nextadvisor With Time

Conventional Mortgage Calculator What Is A Conventional Home Loan Prequalify Calculate Your Monthly Payments Today

Requirements For A Home Equity Loan Or Heloc In 2022 Nextadvisor With Time

Home Equity Line Of Credit Heloc Home Loans U S Bank